Compare the Top Tax Relief and Find the One Thats Best for You. 107-16 shall not apply to the provisions of.

2022 Ford Bronco Sport Badlands Suv Model Details Specs

It was founded in 2000 and has since become a part of the American Fair.

. For that year by virtue of section 133 shall not be given after that date. The amendments made by this section enacting this section and section 4977 of this title amending sections 61 125 3121 3231 3306 3401 3501 and 6652 of this title and section. About the Company Section 132 Tax Relief.

Bilateral relief is given under Section 132 of the ITA when the foreign country has a double tax agreement with Malaysia eg. This beautiful 3 bedroom 2 1 bathroom single-family home in Middlesex County New Jersey was originally constructed in 1985 sitting on a 031 acre lot with a 2 car garage. Trusted Tax Resolution Professionals to Handle Your Case.

Ad 4 Simple Steps to Settle Your Debt. 131 132 133 Schedule s 6 and 7. Tolakan cukai seksyen 110 lain-lain Section 110 tax deduction others Pelepasan cukai seksyen 132 dan 133.

ConsumerVoice Provides Best Most Updated Reviews to Help You Make an Informed Decision. Tax Relief Providers LLC at 283 Clifton Ave Clifton NJ 07011. CuraDebt is a company that provides debt relief from Hollywood Florida.

- BBB A Rating. Section 132 and 133 tax relief. And if any such unilateral relief has been given to him for that year the amount of any such bilateral relief shall be.

A relief from Malaysian tax is given unilaterally pursuant to. Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. Section 132 - Refers to tax relief in respect of income derived from Malaysia which has been subjected to tax in Malaysia as well as countries outside Malaysia.

Tax and sewer payments checks only. Ad As Heard on CNN. Ad Compare the Top Tax Relief Services of 2022.

Singapore Indonesia Japan China Australia South. Free Case Review Begin Online. Start wNo Money Down 100 Back Guarantee.

Solve Your IRS Tax Debt Problems. Receive A Debt Consolidation Loan From JG Wentworth - 3 Decades Of Expertise A Rating. Ad JG Wentworth is Here to Help with Your Debt Consolidation Loan.

131 132 133 Schedule s 6 and 7. Refer to the Form BE. Ad Honest Fast Help - A BBB Rated.

Ad Trusted A BBB Member. What are those that can be filled. Defend End Tax Problems.

A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is. Based On Circumstances You May Already Qualify For Tax Relief. Find Out Now For Free.

Get Professional Help Today. 6652 of this title and section 409 of Title 42 The Public Health. If you owe the IRS any kind of back taxes call us today for a free no hassle consultation.

Get Professional Help Today. Section 11048a of the Tax Cuts and Jobs Act Pub. For the 2020 calendar year under what conditions is a vehicle used in a van pool considered a commuter highway vehicle for purposes of the qualified transportation fringe.

Ad Compare the Top Tax Relief Services of 2022. Title IX of the Economic Growth and Tax Relief Reconciliation Act of 2001 Pub. ConsumerVoice Provides Best Most Updated Reviews to Help You Make an Informed Decision.

Ad See If You Qualify For IRS Fresh Start Program. No cash may be dropped off at any time in a box located at the front door of Town Hall. IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers.

Tax previously repaid From B9 of original Form C. To pay your sewer bill on line click here. 2054 2088 2017 the Act amended section 132g by adding paragraph 132g2.

Section 132 in The Income- Tax Act 1995.

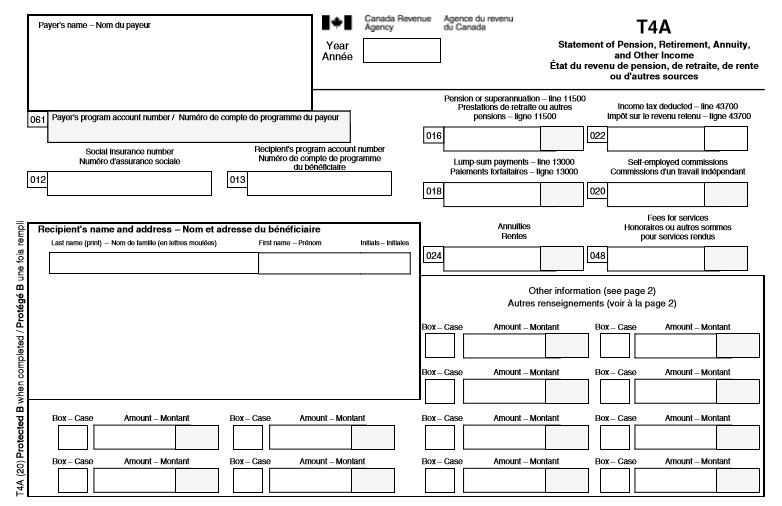

T4a Statement Of Pension Retirement Annuity And Other Income Canada Ca

Promoting The Health Of Older Adults Canadian Scholars

Mortgage Tax Deduction In North Carolina For 2014 Nc Mortgage Expert Freelancer Quotes Real Estate Humor Mortgage Payoff

2022 Ford F 150 Truck Tough Features

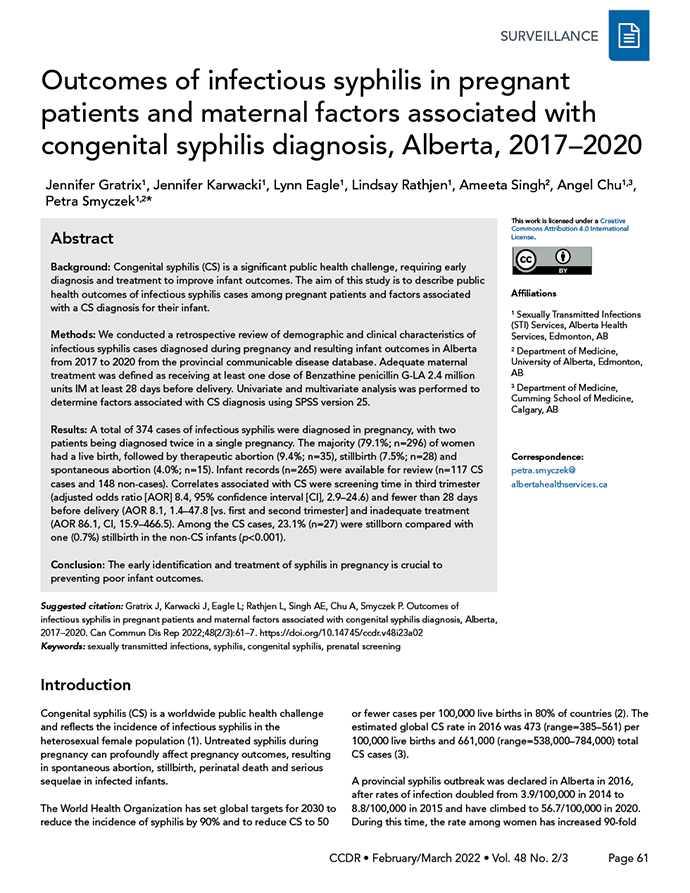

Outcomes Of Infectious Syphilis In Pregnant Patients And Maternal Factors Associated With Congenital Syphilis Diagnosis Alberta 2017 2020 Ccdr 48 2 3 Canada Ca

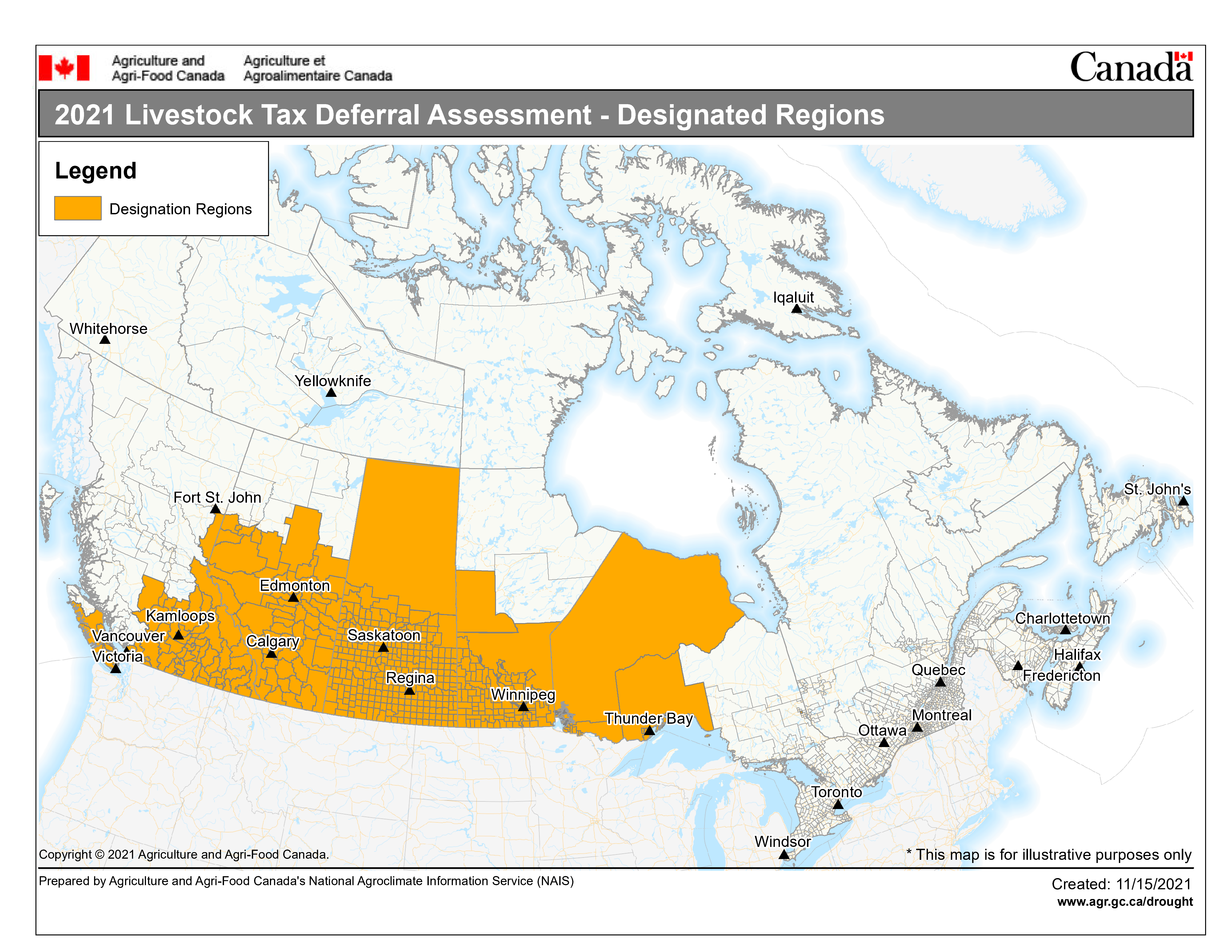

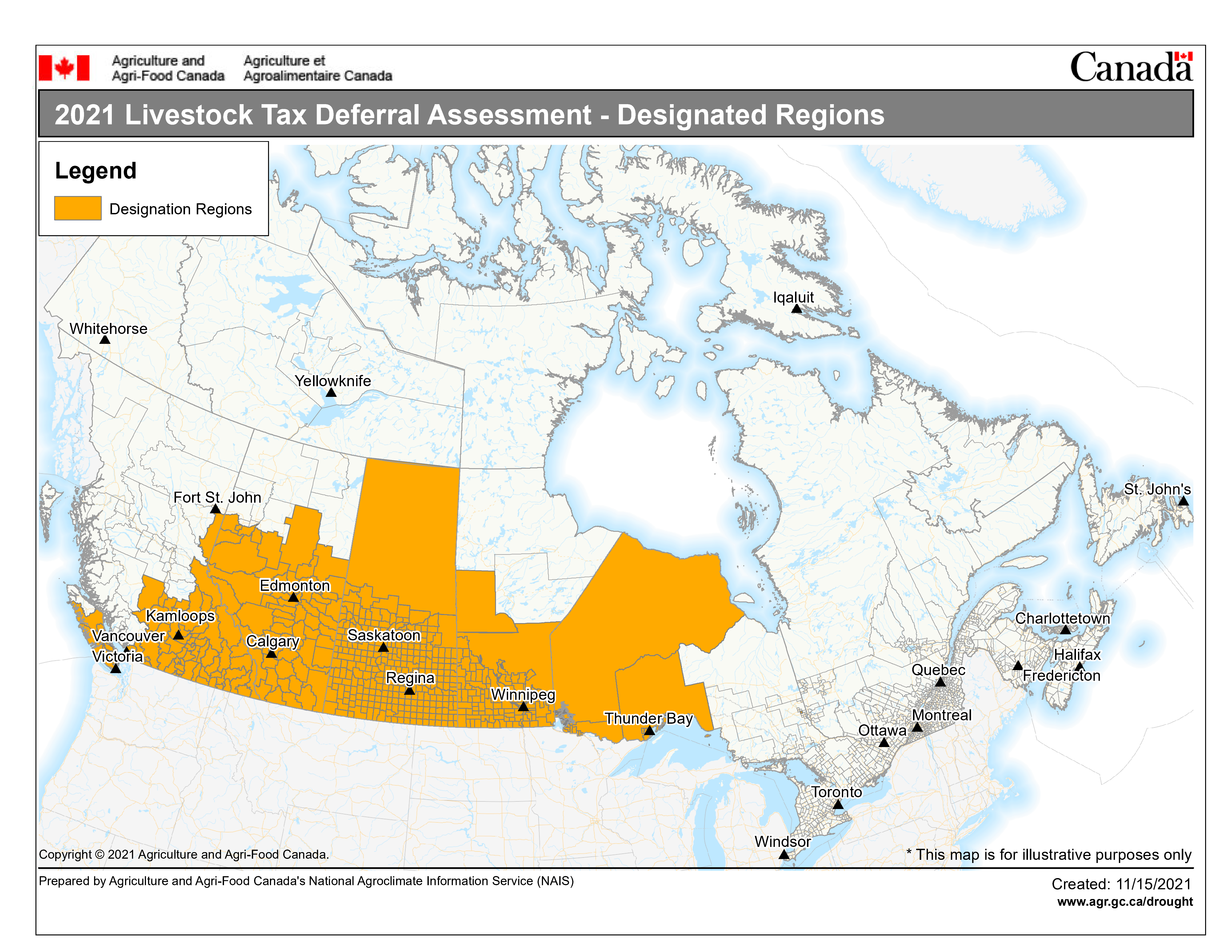

2021 Livestock Tax Deferral Prescribed Regions Agriculture Canada Ca

Financial Awards That Qualify For The Scholarship Exemption 2022 Turbotax Canada Tips

Cartoon Funny Eagle Giving Thumb Up Stock Vector

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

10 Essential Tools For Working With Pallets 1001 Pallets

/ScreenShot2021-07-31at3.56.40PM-f53c6447715749d79f242c0a0759fbb5.png)

Does Unearned Revenue Affect Working Capital

T4a Slip Statement Of Pension Retirement Annuity And Other Income Personal Income Tax Canada Ca

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

2022 Ford Mustang Gt Premium Fastback Sports Car Model Details Specs

Guidance On Monitoring The Biological Stability Of Drinking Water In Distribution Systems Canada Ca